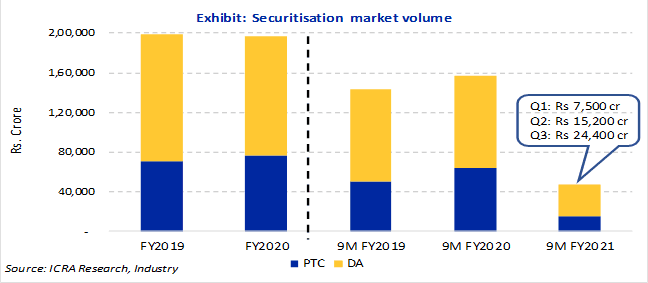

NBFCs-HFCs securitised Rs.24,000cr in Q3 FY2021

Ever since the sharp fall in domestic securitisation volumes seen in Q1 FY2021, the securitisation market has been on a path of revival on a sequential basis, according to ICRA Ltd.

Investors and originators are again seeing securitisation as a viable funding tool given the healthy collections seen across most asset classes post the end of the moratorium period in August 2020 provided under Reserve Bank of India’s ‘Covid-19 Regulatory Package’.

The number of originators that undertook securitisation has also seen an improvement to 50 in Q3 FY2021 as against 45 and 18 in Q2 and Q1 FY2021, respectively. Nevertheless, the securitisation volumes still remain below the pre-Covid levels as reflected in the 48% year-on-year (Y-o-Y) drop in Q3 volumes[1].

The Non-banking financial companies (NBFCs) and housing finance companies (HFCs) securitised about Rs.24,400 crore of its retail loan assets in Q3 FY2021, as per ICRA Ltd, implying a healthy growth of 61% quarter-on-quarter (Q-o-Q).

Abhishek Dafria, Vice President and Head – Structured Finance Ratings at ICRA, said, “The increase in securitisation volumes in the past two quarters could be seen as a sign of the path to normalcy for NBFCs and HFCs at least as far as disbursements are concerned. The Covid-19 pandemic and the nationwide lockdown had led to a major shock to the system especially in Q1 FY2021, but as the lockdowns have eased and the Government has taken steps to revive the economy, the retail loan demand has picked up.

“We have seen healthy increase in securitisation transactions, especially by HFCs in Q3 FY2021. Most investors nonetheless are maintaining stringent filters during pool selection, but there is a considerable increase in appetite for purchase of such retail pools, mainly in the secured asset class, which will augur well for the market. We maintain our annual securitisation volume estimate at 0.8 ~ 0.9 lakh crore for FY2021 with the quarterly growth momentum expected to continue in the next fiscal.”

The securitisation volumes have been largely dominated by the secured asset class this fiscal. The proportion of mortgage-backed securities (MBS) in the total securitisation volumes improved to 42% for Q3 FY2021 compared to 33% in H1 FY2021 as the asset class has seen the least disruption in collections due to the pandemic and consequently, relatively lower spike in delinquencies. Securitisation of gold loan pools, being backed by a stable security, continued to find investors, forming about 15% of the volumes seen in Q3.

Sachin Joglekar, Assistant Vice President, ICRA, elaborated, “Due to the uncertainty in the environment caused by the pandemic, we have seen investors increase their focus to the secured asset class where the losses would be restricted due to the presence of adequate collaterals. The dominance of asset classes like mortgage-backed loans and gold loans is a clear indication of the same.

“On the other hand, unsecured loans like micro-finance loans continue to remain limited in the securitisation market, forming about 5~6% in Q3 FY2021, as against 15%~20% seen in FY2020.

“However, even micro-finance entities have seen a healthy increase in disbursement levels in recent months and we expect their share in securitisation to improve from Q4 onwards as they would have better pool availability meeting the investor criteria. While the delinquency levels have seen an increase across asset classes as expected post the end of the moratorium, ICRA has observed that the credit enhancement available in its rated transactions have been adequate so far to take care of any shortfall in collections which would also give confidence to the investors,” Joglekar pointed out. #banking #loans #lending #economy /fiinews.com