TCF defined by rigorous investment-risk management

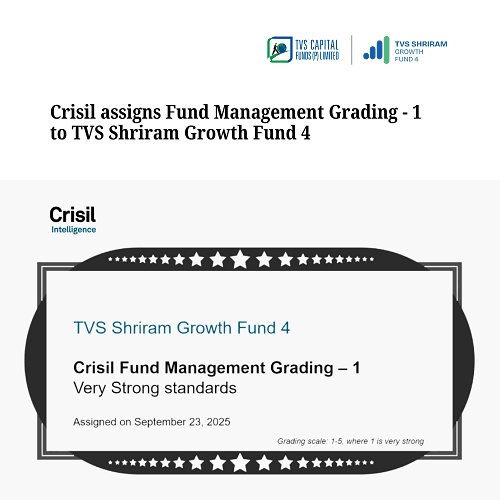

It is a significant milestone for TVS Capital Funds (TCF) as TVS Shriram Growth Fund 4, a Category II Alternative Investment Fund (AIF), has been awarded the CRISIL Fund Management Grading – 1 by CRISIL.

This grading, awarded to select funds in the alternative investment space, validates disciplined investment processes, robust governance, and strong risk management frameworks. This grading is reserved for schemes that follow ‘Very Strong’ standards in investment processes and management practices, as assessed by CRISIL’s rigorous evaluation of factors such as the experience of the investment team, comprehensive monitoring mechanisms, and transparency in client communication.

For investors, this independent validation signals a commitment to institutional-grade governance and sector-driven strategy-qualities that define TVS Shriram Growth Fund 4’s approach to growth capital.

Focused on Financial Services and Enterprise Technology, the fund leverages deep sector expertise and a proven track record across previous funds.

“Independent rating mechanisms such as CRISIL’s play a pivotal role in fostering trust, transparency, and accountability across the AIF industry,” said Gopal Srinivasan, Chairman and Managing Director, TVS Capital Funds.

“As these frameworks gain wider adoption, they can catalyse the flow of long-term domestic capital into venture, private equity, and private credit – sectors vital for driving India’s innovation and sustained economic growth,” he said on 14 Oct.

“Our institutionalisation journey at TCF is defined by rigorous investment and risk management processes, supported by comprehensive portfolio oversight. Our governance structure includes a six-member external investment committee, a seasoned Limited Partners Advisory Committee (LPAC), and a diverse, accomplished board,” elaborated Krishna Ramachandran, Managing Partner, COO & CFO, TVS Capital Funds.

TVS Capital Funds (TCF) is a leading growth private equity fund manager with a legacy of nearly two decades, dedicated to empowering India’s Nextgen entrepreneurs in building enduring businesses. Specialising in Financial Services and Technology, TCF primarily targets the Indian market. With over 35 partnerships and 28 exits, TCF manages approximately Rs.5,500 crore across Fund 3 and Fund 4, making it one of the largest rupee capital funds. Fiinews.com