Middleware platform aims to provide automated underwriting functionality, says Tyagi

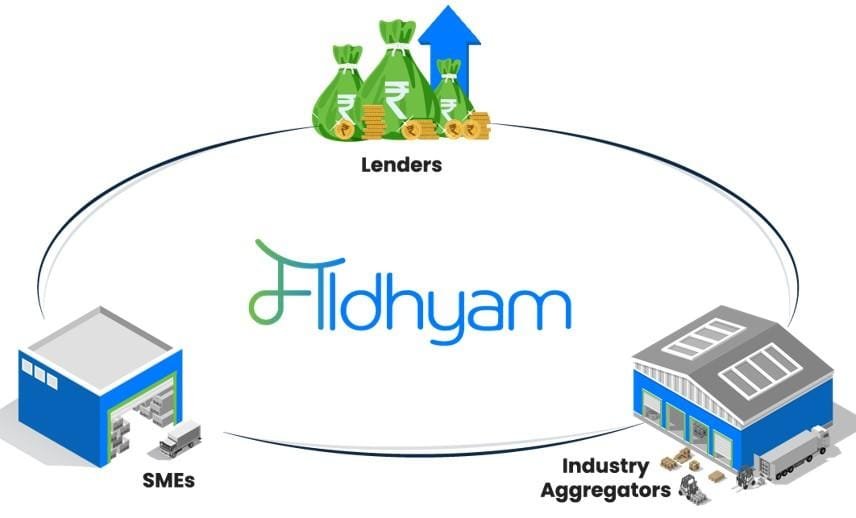

New York-headquartered Biz2X is aiming to invest US$25 million over the next three years to grow its newly launched and first-of-its-kind middleware platform, the India-focused “Maadhyam”, which will bring together Lenders, Industry Aggregators and SMEs for covering the credit gap in the country.

“India has always been our core market. With the launch of Maadhyam, we aimed to script the next phase of Fintech revolution in the country,” Biz2Credit and Biz2X CEO and Co-founder Rohit Arora said at the launch of Maadhyam on 28 Feb 2022.

“Thus, we are aiming to invest US$25 million over the next 3 years to grow Maadhyam.

“We will be aggressively focusing on research, innovation and development of such new-age Fintech products which will help in creating new job opportunities for young graduates in India,” said Arora.

“In the highly competitive banking sector, loans are one of the most business-critical products for banks. Lenders wants to increase the loan portfolios pipeline, but the turnaround time in processing your current lending pipeline is holding you back from coming up with customer-centric innovative products,” elaborated Vineet Tyagi, Global CTO, Biz2X which has an engineering centre in Noida.

“With Maadhyam, we provide lenders with an automated underwriting functionality that reduces the credit turnaround time of their operational expenses considerably. Through Maadhyam, we extend an open offer of collaboration to all Banks as well as NBFCs, Industry Aggregators and Fintechs to integrate and form partnerships,” he said.

With Maadhyam, the aim is to facilitate all the three stakeholders (SMEs, Lenders, and Aggregators) with comprehensive functionality that not only enhances the business processes but also user experience and eventually the growth for all and at all levels.

Maadhyam is a culmination of future-proof technologies like AI, ML, and cloud. While the cognitive abilities of the platform make it easy to build, onboard, and scale. On the other hand, secured SaaS base helps with its widespread availability across all entities involved.

Built for all size of enterprises whether large, medium or small, Maadhyam APIs put community administrators in total control of the proceedings with real-time marketing, analytics, and customizable dashboards. The robust security protecting the Maadhyam platform infuses seamless trust between different entities and communities.

Maadhyam provides an end-to-end solution to enhance the customizable lending experience for small and mid-size businesses in India. It will bring automation and analytics to the lender-borrower equation to empower sustainable and risk-free growth among all partners. Maadhyam enables Banks & NBFC’s to lend more easily, efficiently, and effectively.

At the same time, it gives Industry Aggregators the ability to facilitate seamless and real-time credit among their partner networks. Maadhyam will create an invaluable support system for their partners by giving them competitive credit rates with numerous options along with knowledge support to choose the best one. Last but not the least, Maadhyam benefits the SMEs with faster disbursement of loans by opening up avenues of credit to conduct and scale their business.

The foremost benefit of Maadhyam is that it will facilitate Banks and Aggregators to manage leads from the whitelisted ones to the approved ones and view detailed daily and weekly charts of their credit performance and choose multiple anchors.

With the help of Maadhyam, the lenders will receive the data through APIs while experiencing a reduction in cost of financing loans for MSMEs. Maadhyam will be focused on the 360-degree view of businesses. SMEs can manage multiple types of loans like bill discounting, term loans, BNPL, through the lender portal with minimal documentation.

Biz2X is the leading digital lending platform, enabling financial providers to power growth with a modern omni-channel experience, best-in-class risk management tools and a comprehensive yet flexible Servicing engine.

The company partners with financial institutions to support their Digital transformation efforts with Biz2X’s digital lending platform. Biz2X solutions not only reduces operational expense, but accelerates lending growth by significantly improving client experience, reducing total turnaround time and equipping the relationship managers with powerful monitoring insights and alerts. fiinews.com