Globally, 1 in 3 consumers have begun using digital payments in 2021, says Kawar

Dubai-headquartered Qlub, which has launched its ultra-fast payment solution in the United Arab Emirates, Saudi Arabia and India, has raised US$17 million in seed financing from global investors for expanding into international markets in the near future.

The investment is co-led by Berlin-based Cherry Ventures and Point Nine with participation from other global VCs including STV, Raed Ventures, Heartcore, Shorooq Partners, and FinTech Collective as well as numerous strategic angels, including C-level executives of major players in the digital food industry such as Delivery Hero.

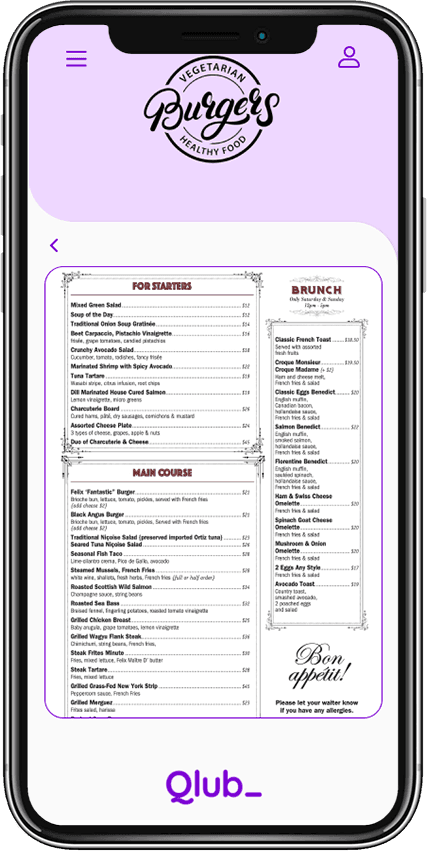

Qlub enables customers to instantly pay their bills in restaurants within 10-seconds by simply scanning a QR code with their phone, even without an app or any registration. Customers can easily split the bill with their friends and pay the bill with Apple Pay, Credit Card or in instalments (“Eat Now Pay Later”).

The benefit for restaurants is multifold, including higher turnover of their tables, higher tips for their waiters, and happier and returning customers. Ratings of restaurants on Google improve significantly.

On another level, Qlub’s digital and contactless payment solution also helps restaurants and customers adapt to widespread situational preferences amplified by the global pandemic. Qlub cuts down on customer-to-employee and customer-to-customer interactions by eliminating physical transactions associated with passing menus and bills back-and-forth.

“Having built multiple food delivery startups, I was baffled by how little the dine-in experience has improved by technology within the last two decades,” says co-founder Eyad Alkassar.

“Since the advent of credit cards, little to nothing has changed. The choreography around waiting for the bill is so avoidable and a waste of time for both customers and restaurants.”

“By combining two mega trends driven by the pandemic, QRs in restaurants and cashless payments, we are creating the payment function of the future. Our ambition is to establish Qlub as the new global standard and save restaurants and customers time and costs,” Eyad said in a release on 1 Feb 2022.

Filip Dames, founding partner at Cherry Ventures, added, “Adapting to a self-checkout solution is a no brainer for restaurants as offline payments remain a barrier to turnover. We are proud to support Qlub in its ambition to revolutionize the payment space for both restaurants and diners.

“The founders have put together a remarkable team and we are excited to take the first step in this journey with them.”

The founding team members of Qlub are Arun Sharma, Eyad Alkassar, Filiberto Pavan, Gizem Bodur, Jeff Matsuda, Jianggan Li, John Mady, Mahmoud Fouz, Oscar Bedoya, Amit Veer and Ramy Omar.

They’ve previously founded and scaled companies like Lazada, Namshi and Snapp. The growing Qlub team already comprises senior veterans from globally leading foodtech companies and top universities around the world. Together, they bring industry knowledge and technical know-how and are all motivated to solve a decades-old problem with technology-minded, future-proof solutions, the founders say.

Ricardo Sequerra Amram, partner at Point Nine, said, “We’re thrilled to back the founders of Qlub who are experienced operators in the food space. Qlub is building a win-win offering for consumers who want the freedom of cashless payments and the convenience of self-checkout as well as restaurant owners who, in a post-pandemic world, are even more mindful of compressing their fixed costs and allocating staff to revenue generating activities.”

“Globally, 1 in 3 consumers have begun using digital payments for the first time within the last year, while more than half (52%) said they transitioned all or most of their in-store spending to online,” said Faisal Kawar, Principal at FinTech Collective.

“The Qlub team have built, scaled, and sold successful businesses across the world, and are well-positioned to go after and grow the US$5 trillion restaurants and hospitality industry worldwide.”

The funding will primarily go towards product development and hiring across tech and product teams.

Qlub is a global startup headquartered in Dubai, UAE which allows customers to pay their bill in restaurants within 10 seconds by simply scanning a QR code with their phone – even without an app.

Furthermore, they can easily split the bill with their friends and later earn loyalty points. Restaurants will benefit from higher turnover of their tables and higher tips for their waiters.

Cherry Ventures is an early-stage venture capital firm led by a team of entrepreneurs with experience building fast-scaling companies such as Zalando and Spotify. The firm backs Europe’s boldest founders, usually as their first institutional investor, and supports them in everything from their go-to-market strategy and the scaling of their businesses. Cherry Ventures has previously invested in the seed stage of over 70 companies across Europe, including FlixBus, Auto1 Group, Infarm, Rows, Forto, and SellerX. Cherry Ventures is based in Berlin and invests across Europe with operations in London, Paris, and Stockholm.

Founded in 2011, Point Nine is a European early-stage venture capital firm focused on B2B SaaS and B2B marketplace startups in Europe and North America. The firm is a seed investor in more than 150 companies in over 30 countries, including Algolia, Brainly, Chainalysis, Clio, Contentful, Delivery Hero, DocPlanner, Front, Loom, Mambu, Revolut, Sqreen and Typeform amongst others. Point Nine has one of the highest “seed-to-winner” rates of the industry.

FinTech Collective is a global venture capital firm backing entrepreneurs who are rewiring the way money moves through the world. Founded in 2012 and based in New York City, the firm has deep experience investing across capital markets, wealth management, banking, lending, payments, insurance, and DeFi. Backed by some of the world’s leading institutional investors, FinTech Collective manages over US$750 million in assets and has invested in 70 portfolio companies. The managing partners of FinTech Collective met in their mid 20’s and helped build, scale, and successfully exit four Fintech businesses. fiinews.com